In Final Weeks Before Election, PBGC Bails Out Several More Failing Union Pensions

The U.S. has more than $220 trillion in unfunded liabilities. What's a few more billion here or there?

By Peter List, Editor | October 26, 2024

With the November 5th elections right around the corner, throughout the months of September and October, the Pension Benefit Guaranty Corporation (PBGC) has been busy approving and announcing the doling out of hundreds of millions of taxpayer dollars to failing union pension plans.

While the plan bailouts are not as large as some of the bailouts provided over the last two years, in total, they are a substantial sum—nearly $900 million.

On September 10th, for example, PBGC announced that it had approved the application submitted by Local Union No. 226 International Brotherhood of Electrical Workers Open End Pension Trust Fund (IBEW Local 226 Fund). The IBEW Local 226 Fund, which is based in Topeka, Kansas, and covers 1,210 participants in the construction industry, will receive approximately $24.8 million in special financial assistance, including interest to the expected date of payment to the plan.

In addition to the IBEW’s plan, on September 10th, the PBGC announced the application approval by the Teamsters Local Union No. 469 Pension Plan (Teamsters Local 469 Plan). The plan, based in Hazlet, New Jersey, covers 1,490 participants in the transportation industry and will receive approximately $107.7 million, including interest to the expected date of payment to the plan.

That same day, September 10th, the PBGC also announced the bailout of the Pension Plan Private Sanitation Union, Local 813 I.B. of T. (Sanitation Union Local 813 Plan). The Teamsters’ plan, based in Long Island City, New York, covers 3,349 participants in a range of industries, including transportation, private sanitation, demolition, rental cars, and funerals. The plan will receive approximately $106 million, including interest to the expected date of payment to the plan.

On October 17th, the PBGC announced that it had approved the application submitted by the Carpenters Pension Trust Fund – Detroit & Vicinity (Detroit Carpenters Fund). The plan, based in Troy, Michigan, covers 22,576 participants in the construction industry will receive approximately $635 million, including interest to the expected date of payment to the plan.

Most recently, on October 23rd, the PBGC announced that it approved the application submitted by the Midwestern Teamsters Pension Plan (Midwestern Teamsters Plan). The plan, based in Oak Brook, Illinois, and covers 615 participants in the transportation industry will receive approximately $23.6 million, including interest to the expected date of payment to the plan.

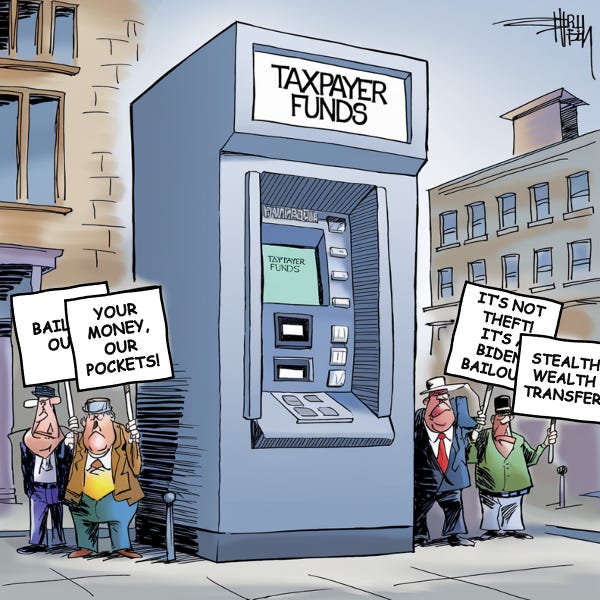

“Special financial assistance for financially troubled multiemployer plans is financed by general taxpayer monies,” the PBGC notes.

While there are multiple reasons behind the decline of many union pensions, the union pension bailout program was created by the $1.9 trillion American Rescue Plan of 2021 signed by President Joe Biden.

Though the American Rescue Plan provided more than $90 billion to rescue failing union pensions, to date, the PBGC has announced $68.6 billion in union pension plan bailouts covering over 1,179,000 workers, retirees, and beneficiaries.

As the American Rescue Plan was passed without Republican support, during the 2024 general election campaign, Democrats and President Biden, in particular, have been keen to remind union voters that it was Democrats—not Republicans—that bailed them out.

With the U.S. nearly $36 trillion in debt, and with more than $220 trillion in unfunded liabilities, there is a fiscal problem looming large no matter which party wins on November 5th.