Has Anyone Else Noticed Starbucks' Stocks Have Been Tanking Since It Became A SEIU Target?

The coffee retailer may be facing a "tidal wave" of union activity that may help sink its stock prices further.

Maybe it’s just a coincidence…

Starbucks is having a rough year.

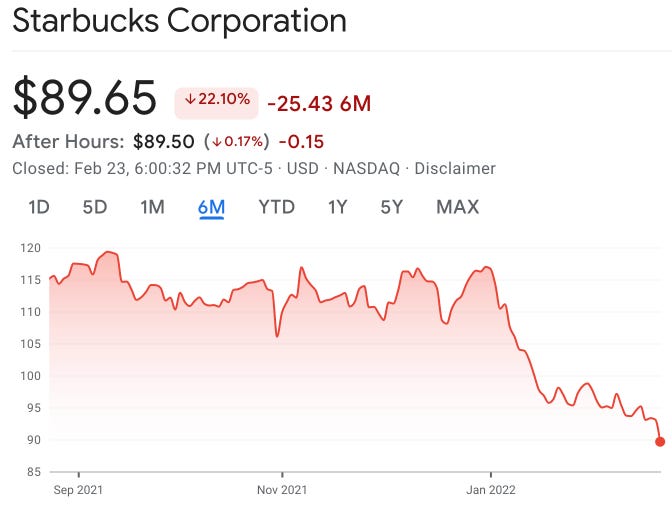

Over the last year, Starbucks (SBUX) stock prices have fallen nearly 15%, and in the last six months, it’s fallen more than 22%.

This is despite the fact that Starbucks’ profits soared 31 percent(!) in the latter part of 2021.

Granted, the coffee giant is having to raise prices to “blunt the impact of the most ferocious inflation in decades” and passing its costs on to consumers.

But, does that fully explain the coffee giant’s stock prices falling steeper than a snowboarder on a black diamond run?

Could it be something else?

Since November, Starbucks has been targeted by a union called “Starbucks Workers Union”—which is an affiliate of the Service Employees International Union (SEIU).

Although the union has only won two elections so far, there are several more ballot counts reportedly happening soon1

On top of that, however, there have been more than 100 petitions filed across the country over the last several weeks, with more being every daily. (In fact, six petitions were filed with the National Labor Relations Board on Tuesday.)

While the number of stores that the SEIU has petitioned for only represent about one percent of Starbucks 9,000 U.S. stores, if more follow suit and Starbucks faces “a tidal wave of additional votes over the months ahead,” as Bloomberg notes, this could begin to impact Starbucks stock prices—especially if investors see the company’s unionization rates as a threat to its performance.

“We find that a winning certification election has, on average, about the same effect on investment as would a 30 percentage point increase in the corporate tax.” —Board of Governors of the Federal Reserve System Finance and Econ

Of course, as has happened in numerous other industries, when unionization rates climb, a company’s economic performance often declines.

As the Employment Policy Foundation found nearly 20 years ago:

…a company with 10 percent of its workforce unionized could experience 2.6 percent higher unit labor cost, and 21 percent lower before-tax profit than its non-union counterpart unless the union impact can be offset by charging higher prices.

Starbucks has already increased prices up to 20% on its Venti-sized cups of coffee at some locations and Kevin Johnson, the president and chief executive of Starbucks stated recently: “We have additional pricing actions planned through the balance of this year, which play an important role to mitigate cost pressures including inflation.” [Emphasis added.]

It is quite possible that Starbucks’ shareholders have not yet noticed—despite all the headlines—the speed at which the SEIU has been able to hit the company across the country.

Perhaps the decline in Starbucks’ stock prices is purely due to other factors, and…

Perhaps the decline of Starbucks’ stock prices is purely coincidental, and…

Perhaps a unionized Starbucks can escape the same fate as so many other unionized companies before it, and...

Perhaps, consumers and shareholders will realize that a “venti”-sized cup of coffee really is just a large cup of coffee after all.

Related: The Union Tax: How Unions Cost Companies And Jobs

Several ballot counts have been delayed due to the National Labor Relations Board impounding the ballots while unit determination arguments are heard by the NLRB in Washington, DC.